Medical insurance for expatriate Indigo Expat WeCare & OnePack – 2023

First of all, conditions of your medical insurance for expatriate Indigo Expat WeCare or OnePack change on April 1st, 2023. Thus, premiums as well as services or benefits are reviewed. Practically speaking, changes intervene:

- for existing clients: at renewal date in 2023,

- for new clients: for any policy with a start date from April 1st, 2023.

Changes are summarized in this document.

Which parameters impact medical insurance for expatriate’s premiums?

In general, one considers that the following parameters do impact international expatriate health insurance:

- experience of the past year,

- technical results,

- medical inflation.

Medical insurance for expatriate – Experience of past year

The war in Ukraine had consequences for insurances. For example, you can find one consequence in the updated list of excluded countries. Also, the unstable situation in Lebanon and the unstable exchange rate lead us to suspend access to our plans for this country of expatriation.

It is clear that inflation affects everyone. Also, the decision was made to focus on the protecton of purchasing power for this renewal. And therefore to limit the premium’s increase as much as possible.

Technical resultats ot the medical insurance for expatriate

To sum up, technical results are good. This means for 1st Euro plans, as well as Top Up plans to CFE. Nevertheless, medical consumption is higher with Top Up plans to CFE. That’s why an increase is required.

In this period of inflation, the chosen option is to limit the increase of premiums. To do this, the limit of the vision care benefits is reviewed. The limit apply now over a 2 years period of insurance. In the vast majority of cases, this change will have no impact.

Technical results are good due to members’reasonable behaviour. So thank you all for playing the game! Your daily actions and choices do have an impact on technical results. And our goal is for you to fully benefit from your efforts the following year.

Medical insurance for expatriate – Medical inflation

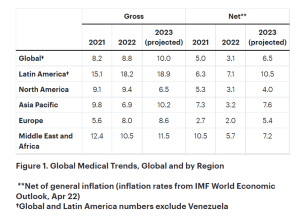

Based on WTW report, global medical inflation stands at 8,80% in 2022. That is to say that healthcare costs increase by an average of 8.80% in 2022 compared to 2021. This explain why the Insurer needs more money to reimburse the same claims as the previous year. WTW estimates at 10% the medical inflation in 2023.

You can check previous reports through this page.

Medical insurance for expatriate – index for 2023

Given the results of our contacts, we take the risk of indexing premiums to the minimum required. But we keep in mind that insurance is all about probabilities and cycles. Also that medical inflation is projected at 10% in 2023. We are counting on you to contain claims and the loss ratio in 2023. Indeed, this will prevent us from having to apply a significant increase next year.

Medical insurance for expatriate – Indigo Expat OnePack

The index to review the medical insurance for expatriate’s premiums (Indigo Expat OnePack) is:

- Zones 1 & 2 : +2,0%

- Zones 3 & 4 : +4,5%

Please note that the premium of your medical insurance for expatriate takes also into account the age of each member.

Finally, premiums for Assistance, Personal Liability and Individual Accident remain the same.

Medical insurance for expatriate- Indigo Expat WeCare

The index to review the medical insurance for expatriate’s premiums (Indigo Expat WeCare) is:

- Zones 1 & 2 : +0,0%

- Zones 3 & 4 : +0,0%

Please note that the premium of your medical insurance for expatriate takes also into account the age of each member.

Finally, premiums for Assistance, Personal Liability and Individual Accident remain the same.

ACME fees

ACME fees do not change in 2023. It remains 24 Euro per year and per file.

Tools associated to your medical insurance for expatriate

First of all, medical care is a business in many countries around the world. Therefore, the cost significantly vary from one practioner to another. And also can be negotiated. That’s why specific tools have been implemented, such as:

- Prior approval allows the medical team to check pathology, treatment and estimated costs are in line with local practice.

- MSH International medical network includes practioners whose practices and prices allow optimal care. That is to say when tariff agreements have been implemented. Or agreements for direct settlement.

- Medical concierge: this service offers the opportunity to find medical alternatives. The Insurer’s medical unit exchanges with the member to find and propose alternatives. Example: instead of getting treated for a cancer in Thailand (approx. 250 000 USD), the Insurer offers the opportunity to fly to France and to get treated in a specialized center there (approx. 30 to 50 000 Euro).

Medical insurance for expatriate – Cost containment

In the vast majority of cases, the purchase of a pair of glasses is not medically necessary every year. The choice was difficult, but it seemed more acceptable to us to favor everyone’s budget. Also, the limit on this benefit now applies over a 2 years period of insurance. This change reduces the increase of premiums.

Local insurance: if you are locally insured, do not hesitate to use the local insurance first. Anything that is not reimbursed by Indigo Expat improves the technical results of the contract. In this case, send the reimbursment statement instead of the original invoice to MSH International. This practice is virtuous, and has a positive impact on premiums the following year.

Medical insurance for expatriate & Medical check up

First, prevention is always preferable to disease. On one hand, for the insured and from a human point of view. On the other hand, for the contract and from a financial point of view (premiums). In the long run, and despite the cost of a health check, it will still be less expensive than hospitalization and treatment. And much better for the member!

If one considers the French social security, it is really necessary to start with health check between 40 and 50 years. Because it is from these ages that health concerns can begin (dental prostheses, vision care). But more consistently, it is also a period when cancers or other serious pathologies can be discovered. The earlier the diagnosis can be done, the most chance of recovery has the member, for certain pathologies. That’s why the “Health and wellbeing checks” benefit has been revised to better cover this expense!

We recommand the Centre Médical International (CMI, 38, quai de Jemmapes, 75010 – Paris. Phone: +33 (0)1 43 17 22 00) for your complete Health Check (available in French and English). It takes approximatively half a day to complete.

Medical insurance for expatriate & local regulation

Please note that subscribing to a medical insurance for expatriate does not free you from local regulations. Our plans are not substitute for local mandatory insurances.