Indigo Expat insurances – 2025 conditions

As every year, terms and conditions of our Indigo Expat insurances change on April 1st, 2025. This applies to Indigo Expat WeCare and OnePack plans. From a practical perspective, changes will take effect:

- for existing clients: on the renewal date of their contract,

- for new clients: fon the effective date of their policy. This means starting April 1st, 2025.

The insurance certificate and information leaflets will reflect the new terms and conditions. These documents are available in your Member Area online (MSH).

Indigo Expat insurances – technical aspects

Technical parameters are taken into account from one year to the next to define the terms and conditions of Indigo Expat insurances for expatriates. These parameters include:

- the previous year’s experience,

- technical results,

- medical inflation.

1. Previous year’s experience

The geopolitical context has an influence on inflation in general. This will have an impact on the medical and pharmaceutical industries. Furthermore, we note a surge in rates charged in certain countries, which are unrelated to underlying trends. Some are suggesting a catch-up phenomenon linked to Covid. Practioners and hospitals are reportedly charging significantly higher rates to make up for lost revenue during the Covid period. This trend is particularly observed in Thailand and Mexico. This is leading several Insurance Companies to review their zones of coverage.

2. Technical resultats

Reimbursment and direct payment to hospitals constitute claims. The amount of claims is compared to the amount of premiums. The ratio between claims and premiums is the loss ratio. If the ratio is greater than 100%, it means that the Insurer has paid out more claims than it has collected in premiums. Therefore, the Insurer has lost money. If it is lower to 100%, the Insurer earned money. Even if the medical consumption may be stable, there are uncertainties and cycles in insurance. Therefore, the Insurer doesn’t really earn money. Indeed, the gains of several years generally serve to offset the losseds of a single year. The cycle occurs approximatively every 3 or 5 years. The gains of a few years make the evolution of premiums more linear. Otherwise, there could be too many flcutuations in the evolution of premiums.

Technical results deteriorated in 2024. This is particularly true for First Euro contracts. However, contracts on top up to CFE are not exempt. This mainly concerns large number of hospitalisations in 2024.

CFE reviewed its zones of coverages in 2024. For 13 countries, CFE decided to reimburse less in 2024 than in 2023. This change starts to impact Indigo Expat OnePack, which intervene on Top Up plans to CFE. Indeed, benefits are expressed as a purcentage of expenses. By reducing its coverage, CFE transfers the difference to the Top Up plan. Or to the member. This withdrawal from CFE contributes to the deterioration in results. Even if not all expatriates are affected by these 13 countries, mutualization within a zone of coverage generate the link.

![]() ⇒ Changes at CFE on January, 1st 2024

⇒ Changes at CFE on January, 1st 2024

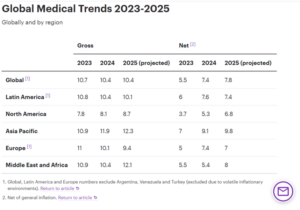

3. Medical inflation

Global medical inflation stands at +10.4% in 2024. This means that healthcare costs increased by an average of +10.4% in 2024 compared to 2023. To reimburse the same expenses as the previous year (doctors, pharmacy, etc.), the Insurer needs +10.4% in premiums. This is one of the reasons why insurance rates increase every year.

For 2025, global medical inflation is projected at +10.4%.

One can note high medical inflation on past years. While the good results of previous years have significantly cushioned the impact of medical inflation, this can not be done indefinitely. Medical inflation is therefore having a greater impact on renewal conditions this year. In conclusion, please note that this impact is even more true in expensive countries like China, Hong Kong and Singapore.

Indigo Expat insurances – index

Indigo Expat insurances – index

Members have to consider out patient expenses on one side. And hospitalizations on another side. Hospitalization represents the real risk. For out patient expenses, Insurers consider them as medical consumption. This is because members’ decisions have a significant impact on these benefits. Therefore, technical results of Indigo Expat insurances are largely the result of members behavior.

The more members remain reasonable for their medical expenses, the more they can benefit from the consequences of their choices the following year. Our goal is to ensure you fully benefit from your efforts. We take into account technical results by zone of coverage and medical inflation to define index. One again, our goal is to protect your purchasing power.

Terms and conditions of Indigo Expat insurances are tracked by our competitors. Therefore, we provide you with details directly.

Indigo Expat insurances – services

Indigo Expat insurances – services

First of all, medical care is a business in many countries around the world. Therefore, the cost significantly vary from one practioner to another. And also can be negotiated. That’s why specific tools have been implemented, such as:

- Prior approval allows the medical team to check that pathology, treatment and estimated costs are in line with local practice.

- MSH International medical network includes practioners whose practices and prices allow optimal care. That is to say when tariff agreements have been implemented. Or agreements for direct settlement.

- Medical concierge: this service offers the opportunity to find medical alternatives.

Indigo Expat insurances – cost containment

Indigo Expat insurances – cost containment

Local insurance: if you are locally insured, do not hesitate to use the local insurance first. Anything that is not reimbursed by Indigo Expat improves the technical results of the contract. In this case, send the reimbursment statement instead of the original invoice to MSH International. This practice is virtuous, and has a positive impact on premiums the following year.

Indigo Expat insurances – prevention

Prevention

First, prevention is always preferable to disease. On one hand, for the insured and from a human point of view. On the other hand, for the contract and from a financial point of view (premiums). In the long run, and despite the cost of a health check, it will still be less expensive than hospitalization and treatment. And much better for the member!

If one considers the French social security, it is really necessary to start with health check between 40 and 50 years. Because it is from these ages that health concerns can begin (dental prostheses, vision care). But more consistently, it is also a period when cancers or other serious pathologies can be discovered.

Health and wellbeing checks

The earlier the diagnosis is made, the faster the condition can be treated. This always has a positive effect on the member’s health. Keep in mind that you have access to “Health and wellbeing checks” benefit from the second year of coverage. This applies to Indigo Expat WeCare and OnePack insurances.

Digital checks with ACME

ACME Association is studying the opportunity of offering digital checks to its members (adults only) in 2025. These digital checks cover both physical and psychological aspects. Proposed by Eutelmed, they consist of 2 digital sessions, each lasting approx. 10 minutes. These sessions allow for a one-off assessment identifying best pratices and risks. while they don’t reinvent the whell, these digital checks are a great opportunity to take stock of your health. Of course, the tools ensure confidentiality and data security.

Funded through membership fees, these digital checks would be free for members. If this project is confirmed, you would recieve a specific communication by email. The idea would be to conduct this type of campaign every three years, for example. However, participation and feedback on the potential first edition will determine the future.

![]() ⇒ Eutelmed

⇒ Eutelmed

Indigo Expat insurances & local regulation

Please note that subscribing to Indigo Expat insurance does not free you from local regulations. Indigo Expat insurance is not substitute for local mandatory insurances.